Editor’s note: AAOS Now has covered out-of-network (OoN) billing in several previous articles, but the subject remains active in many state and federal legislative bodies. This article focuses on pending legislation and other potential solutions to address OoN billing as of May 1. (See the sidebar for a more recent legislative update.)

Since the passage of the Affordable Care Act, insurers have increasingly offered products with narrow, inadequate, and nontransparent networks. For those purchasing or electing coverage, a given product’s limitations in access to covered care are not well understood. For example, the nuances of highly profitable, narrow network coverage are rarely understood by customers until they receive a “surprise” bill. In such cases, uninformed patients receive out-of-network (OoN) care and incur substantial out-of-pocket costs.

Federal legislation that would make insured patients not liable when they receive surprise bills has bipartisan sponsorship from a workgroup led by Senator Bill Cassidy (R-La.).

What are possible solutions?

Proposed legislative solutions fall into two categories. The first type would ban balance billing when a patient did not consent to receiving OoN care and would set prices to federally mandated fee schedules based on predetermined benchmarks—either a percentage of the Medicare reimbursement amount, a percentile of usual and customary charges as determined by an independent database such as FAIR Health, or an average of in-network rates.

The second type would involve changing contractual relationships—such as having an independent dispute-resolution process, whereby an independent arbitrator would choose between the health plan and physician offers to determine the reimbursement amount instead of establishing the amount independently.

Another potential contractual change would require hospitals to negotiate for independent emergency physicians, anesthesiologists, radiologists, pathologists, and assistant surgeons. Hospitals would negotiate prices with insurers for independent physicians’ rates for specialties. These efforts would fundamentally change the American healthcare market—hospitals would take the role of “buyer” of specific physician services (pathology, radiology, emergency department [ED] services, etc.) and seller of combined ED/pathology/radiology/etc. and facility services to insurers.

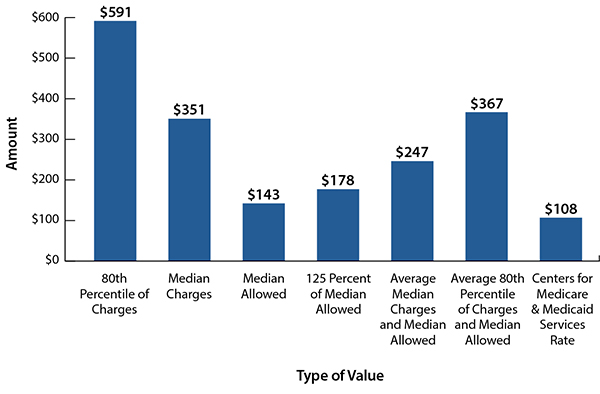

The problem with any mandated fee schedule is that, over time, it becomes the price point to which all in-network contracts are negotiated, thereby removing any genuine ability for physicians to negotiate their services. If insurers could pay contractual rates for OoN services, they would have little incentive to negotiate in good faith for fair reimbursement; that would drive down contractual rates. FAIR Health created a helpful policy paper to show differences in payment rates for various solutions being considered by Congress (Fig. 1).

FAIR Health, an important entity in the OoN debate, was created in October 2009 as part of the settlement of an investigation by New York state into health insurance reimbursement practices by UnitedHealthcare. UnitedHealthcare settled a lawsuit brought by New York state, which accused the insurer of manipulating data to lowball reimbursement rates for physicians. A portion of the settlement was used by then–Attorney General Andrew Cuomo to create FAIR Health. Today, according to FAIR Health, it “manages the nation’s largest database of privately billed health insurance claims.”

Current state and federal legislation

In January, state legislators introduced laws banning balance billing, curtailing surprise charges, and setting payment rates for OoN reimbursements.

Regarding surprise billing, state legislation revolves around four different policy solutions: not holding patients liable, prohibiting provider balance billing, creating a payment standard, and instituting a dispute-resolution process.

State laws cannot directly regulate self-insured health plans—which comprise most employer-sponsored insurance—due to the Employee Retirement Income Security Act of 1974 (ERISA). Thus, patient and consumer advocates are leaning heavily on Congress to enact a solution.

A bipartisan group of senators, including Senators Cassidy, Tom Carper (D-Del.), Todd Young (R-Ind.), Claire McCaskill (D-Mo.), Michael Bennet (D-Colo.), and Chuck Grassley (R-Iowa), has unveiled draft legislation that would ban balance billing if consent is not obtained and set payment to either a state-mandated rate or “median in-network rates or 125 percent of the average allowed amount by private plans.” (See Sidebar for a more recent legislative update.)

AAOS, along with the American Society of Plastic Surgeons, sent comments to Senator Cassidy on the proposal.

The comments included five asks: ensure adequate insurance networks, hold patients not liable under all circumstances, retain a balance billing option, ensure fair and timely payment, and clearly address ERISA plans. To read the comment letter, visit https://bit.ly/

2UJ2KSM.

Congress is currently considering several other proposed laws, as of March (Table 1).

What is AAOS doing to advocate for access to musculoskeletal care?

AAOS is advocating for the following components to be part of any final federal legislation:

- Ensure adequate insurance networks. Incorporate specific, quantitative standards that require insurance networks to maintain a minimum number of active physicians, have accurate physician directories, and provide transparent OoN options for patients.

- Take patients out of the middle. Patients must not be held liable. Carriers should reimburse providers directly and avoid patient confusion.

- Retain a balance billing option. In nonemergent situations, balance billing should be permitted if a patient is adequately informed and knowingly receives OoN care.

- Ensure fair and timely payment. Plans must use a truly independent database to determine usual and customary rates. By setting payment to “median in-network amounts,” insurers have little incentive to contract with on-call providers, as they can rely on statutory rates.

- AAOS opposes setting OoN reimbursement to a percentage of Medicare or artificially setting below-market payment rates.

If musculoskeletal physicians lose this battle and insurers prevail in maintaining narrow networks with inadequate provider panels and continue placing a greater share of the costs on patients, physician services will be permanently devalued, and patient access will be compromised.

Rory Wright, MD, is a member of the AAOS Board of Councilors.